Add a line item called "extras" that equals 10 to 15 percent of your total budget to cushion for things you'll likely forget (postage for your save the dates and wedding invitations, parking valets) or won't anticipate in advance (cake-cutting fees, welcome bag for out of town guests).If not, do the math yourself using local tax rates to adjust the total amount so that it's accurate.

Monthly income: After you've paid your monthly recurring expenses (like rent or mortgage payments, car insurance, student loan payments, etc.), set aside up to 10 percent of your earnings each month to put towards the wedding.įirst, open a joint account to pool your savings for the wedding and set up automatic monthly direct deposits into this account from your paycheck.Subtract those already-spoken-for savings amounts from your total balance in the bank and that's how much you could potentially put towards the wedding. You might also have separate savings set aside for future purchases, like a home or a car. Savings: Ideally, you and your partner have an "in case of an emergency" fund set aside should a job loss or a health setback arise (this would be separate from retirement funds).The amount you and your fiancé are able to contribute involves taking a hard look at your savings and monthly income. Contributions from parents or loved ones (if applicable).This amount will likely come from three sources of funds: The first step in creating a wedding budget is to figure out how much money you actually have to spend.

#WEDDING BUDGET PLANNING HOW TO#

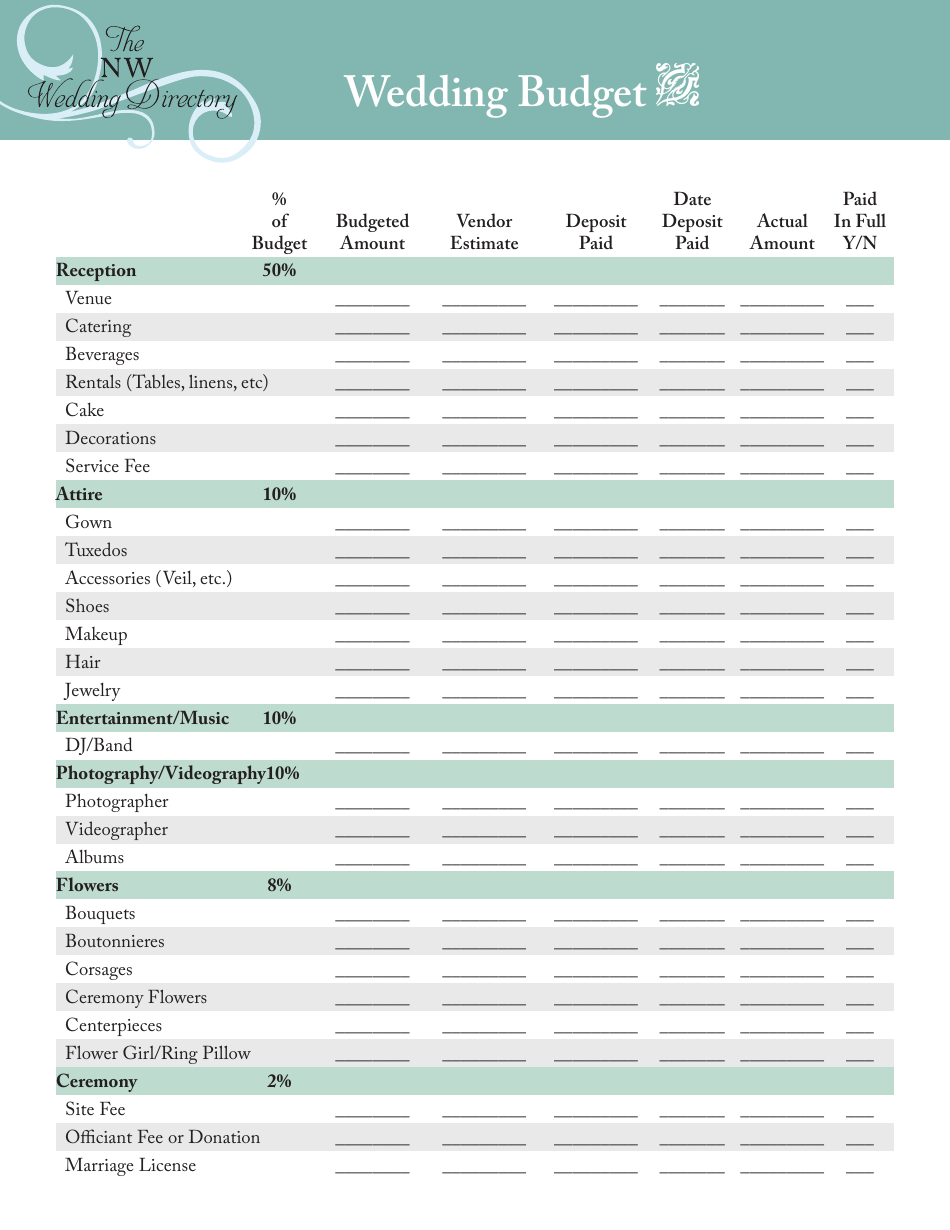

Here's exactly how to set a wedding budget you can stick to. It's not easy, we know, but putting in the time and energy now to create a well-planned-out wedding budget will ensure that you'll have the wedding of your dreams (without going into debt!). Keeping close tab of your expenses will help you stay on-track during the planning process and prioritize where you want to spend, as well as make necessary cost cuts, so you don't exceed your total budget. To make a wedding budget, you'll need to tally your wedding savings, and then create and maintain a detailed wedding-expenses spreadsheet. But use these average wedding budget percentages as a starting point and then customize them to create your own. Just remember that your wedding costs and wedding budget percentages will vary depending on where you’re getting married and the size of your guest list. You may choose to spend more or less in certain areas depending on your preferences and personality, and that’s totally fine. How you choose to divvy up your own wedding budget is entirely up to you (along with whomever else is paying for the wedding). Keep in mind, though, that these are just averages. To help you figure out how much you’ll need to allocate for the various aspects of the celebration, such as catering, attire, flowers, music, etc., we’re sharing the average wedding budget breakdown below. And lastly, we'll go over a sample wedding budget so you can see how the numbers shake out so that you can create your own. Next, we'll share our best tips and strategies on how to set a wedding budget (and stick to it!). First, we'll outline a typical wedding budget breakdown, with wedding budget percentages of how much you will likely need to allocate for all the different aspects of the wedding. Here, we'll walk you through everything you need to know about wedding budgets. Determining your wedding budget might be a little tricky, but this number will affect every decision and purchase you’ll make, so it’s important to work out your budget so you have a realistic picture about what you can spend. First things first: Figuring out how you’ll pay for the wedding. Congrats, you’re engaged! Now what? Once you’ve shared the happy news with your nearest and dearest, it’s time to start thinking about wedding planning.

0 kommentar(er)

0 kommentar(er)